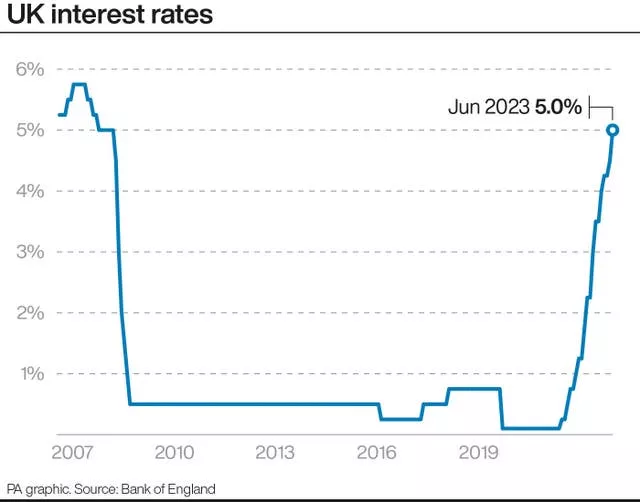

The Bank of England has unexpectedly pushed up interest rates in the UK to 5 per cent, the highest rate in almost 15 years, as policymakers and the British government come under mounting pressure to control the cost-of-living crisis.

The move is set to deepen the mortgage crisis as borrowing costs are hiked up for the 13th time in a row.

The 0.5 percentage point increase was the sharpest increase since February, surprising economists who had been expecting a smaller hike of 0.25 percentage points.

Governor of the Bank of England Andrew Bailey said: “The economy is doing better than expected, but inflation is still too high and we’ve got to deal with it.

“We know this is hard – many people with mortgages or loans will be understandably worried about what this means for them.

“But if we don’t raise rates now, it could be worse later.”

It follows a higher-than-expected inflation reading in May as continued price rises forced policymakers into action in a bid to bring inflation down to the 2 per cent target.

It comes amid growing calls for the UK government to do more to help mortgage borrowers who are set for a big jump in their monthly repayments.

British finance minister Jeremy Hunt and prime minister Rishi Sunak have so far dismissed suggestions that ministers could intervene.

However, Mr Hunt is set to meet with lenders on Friday as pleas grow for more to be done and met with consumer champion Martin Lewis, who on Tuesday said that a mortgage ticking time bomb is now “exploding”.

Concerns over continued increases in wages alongside persistent goods and services inflation had already driven mortgage rates higher in recent weeks.

Financial markets have predicted that interest rates will strike a high of 6 per cent by early next year amid warnings that 1.4 million mortgage holders will lose at least a fifth of their disposable income in additional repayments.

The central bank’s Monetary Policy Committee (MPC) said on Thursday that it made the decision to hike rates more sharply due to “the background of a tight labour market and continued resilience in demand”.

Seven members of the nine-person MPC opted for the increase to 5 per cent, but two members called for rates to remain flat.