The UK's financial watchdog has launched a probe into the failed company at the heart of a lobbying story.

The Financial Conduct Authority (FCA) said it is formally investigating how two Greensill companies failed, and how one of them was overseen by a company whose licence it piggybacked on to operate in the UK.

FCA boss Nikhil Rathi said that there have been a number of allegations about the circumstances in which Greensill failed, “some of which are potentially criminal in nature”.

“We are also co-operating with counterparts in other UK enforcement and regulatory agencies, as well as authorities in a number of overseas jurisdictions,” he said in a letter to British MPs on the Treasury Select Committee, released on Tuesday.

US-based Mirabella Advisers allowed Greensill Capital Securities to sell products in the UK using its license with the FCA.

In March Mirabella ended its relationship with Greensill which had been in place since 2017.

It made Greensill Capital Securities an appointed representative (AR) of Mirabella.

“A principal firm (in this case, Mirabella) is responsible for ensuring that, on an ongoing basis, its AR complies with the requirements, rules and regulations of the FCA,” Mr Rathi said.

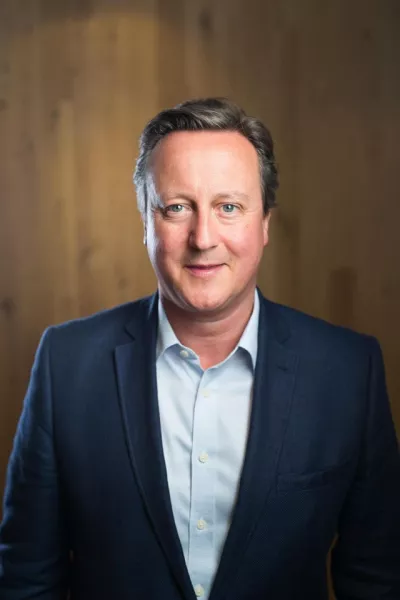

Greensill collapsed earlier this year and its relationship to former British prime minister David Cameron, who lobbied for the firm, has been thrown into the limelight.

The company’s main business was so-called supply-chain finance, which ensures that suppliers get paid more rapidly by their customers than normal.

Greensill would pay suppliers directly, and then collect the money later from the customer. It made its money by charging a fee that offset the risk of the customer going bust before it could pay.

Greensill’s collapse caused shockwaves among its customers, with worries that some could fail, putting thousands of jobs on the line.

But Greensill also had a product that it wanted to run with the UK's health service which would – for free – offer to pay nurses and doctors their salary on a daily basis.

It would, Greensill argued, reduce their need for payday loans.

However, FCA notes released on Tuesday show that in 2019 founder Lex Greensill said that the scheme would be free for the health service, but that it was an “add on” product as “they are already making a lot from Greensill contracts”.

Mr Greensill offered the service to 18 other employers as a “foot in the door,” the FCA notes reveal.

At the time FCA executive director strategy and competition Christopher Woolard warned that good innovative ideas can go wrong, but that there could also be upsides.