The former chief executive of Custom House Capital (CHC), jailed for his role in a sophisticated €61 million conspiracy to defraud investors in the firm over a decade ago, has appealed his prison term, arguing it was wrong for a judge to “pluck” a headline sentence of 14 years “out of the air”.

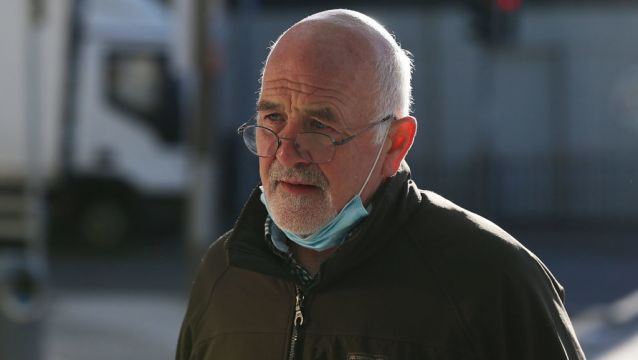

Harry Cassidy (68), of Clon Brugh, Aitkens Village, Stepaside, Dublin pleaded guilty to conspiring with others to defraud investors in, and clients and customers of, CHC by intentionally misleading them as to where and/or how their assets had been placed contrary to common law.

All of the offences occurred within the State on dates between October 1st, 2008 and July 15th, 2011.

Victim Impact Statements

A total of 197 victim impact statements were submitted at the sentence hearing, where CHC clients spoke of the financial losses they had suffered and of the emotional and psychological effects they and their loved ones had faced over the last 10 years.

Some statements also outlined the devastating impact of the loss of savings and investments intended to provide a pension.

The nephew of one German victim told the court that his aunt's life work was “effectively stolen” by Cassidy, who he said “did more damage” to her life than the Second World War.

Judge Orla Crowe began with a headline term of 14 years when Cassidy was sentenced at Dublin Circuit Court last May but reduced this to seven years, after taking mitigation into consideration.

Cassidy was also given credit for the two months he spent in custody in Germany, giving him an effective sentence of six years and 10 months.

Judge Crowe said victims were “systematically deceived in a sophisticated operation” which was carried out for over two years by people who owed them fiduciary duties. She said the offending was “most egregious” and involved a “gross abuse” of trust and duty.

She said the fact that the fraud involved pension money was a “particularly aggravating factor”.

Financial crash

The court previously heard that CHC had entered agreements to buy properties in mainland Europe at the time of the financial crash.

In 2008, CHC began to use client funds to meet these obligations, often without the knowledge or authorisation of clients.

CHC's liquidator Kieran Wallace said €61 million in client funds were found to have been misappropriated. €41 million (64 per cent) of this amount has been recovered, with clients receiving €39 million so far as of March 2023.

A total of €253.4 million across over 3,000 accounts was held by the company on the date of liquidation.

At the Court of Appeal on Tuesday, Hugh Hartnett SC, for Cassidy, said a decision had been made at the time to borrow “from Peter to pay Paul” in the hope that “things would come right eventually”.

He said this should be distinguished from other cases where money was “embezzled” solely for personal gain or to fund a certain lifestyle.

“There is a moral difference,” he said. “The court failed to take that into consideration significantly when passing sentence.”

He suggested the headline sentence was “wrong” and should not have been set at 14 years, arguing that anything more than 10 years was incorrect.

Counsel for the State asserted there was no error in sentencing and said the discount of almost 50% to the original headline sentence given by the judge was “extraordinarily generous” in the circumstances.

“The damage that was wrought by the scheme put in place by Harry Cassidy is something that has not been seen by this country before,” said counsel for the DPP Lorcan Staines SC, noting that a total of 202 victims came forward to give statements in the case, a number of whom were present in court for the appeal hearing today.

Mr Hartnett told the three-judge appeal panel it was wrong for a court to “merely pluck” a figure of 14 years as a headline sentence “out of the air”.

“One cannot have an arbitrary decision without any principle behind it,” he said. “There must be a reference to clear principles, for instance a reference to comparator cases or to legislation. There must be some form of grounding, some sort of plinth for this and there wasn’t.”

He suggested the judge erred in imposing a sentence which was disproportionate having regard to similar sentences imposed including those imposed on the appellant’s co-accused.

Mr Hartnett submitted that the sentence was “excessive, disproportionate, overly punitive and oppressive in all the circumstances”.

Mr Staines said the maximum sentence for these offences was one of life in prison. He said the trial judge had to select a point on the scale from “zero to life in prison” and from that point she then took mitigating factors into consideration when deciding what discount to give.

He said the judge couldn’t have placed this case in any category other than the highest end of the ranges available.

Mr Hartnett also argued that the sentencing judge failed to take account of a number of mitigating factors in the case, including the appellant’s advancing age and health issues.

He said Mr Cassidy was undergoing tests for cancer at the time of sentencing and has subsequently been diagnosed with prostate cancer, for which he is receiving treatment in prison.

Bankruptcy

Cassidy had also lost his family home, had been obliged to enter into bankruptcy and had lost his career in financial management. “When he walks out of prison he can never work in his chosen field of financial management again and surely that is a significant factor,” said Mr Hartnett.

He said prior to his incarceration, the appellant had been working as a foreign language teacher online earning about €24,000 a year.

Counsel further submitted that the judge erred in failing to afford the adequate weight to the evidence that Cassidy was motivated by an intention to preserve and protect monies invested in Custom House Capital.

He said a decision was made to move money around from accounts “borrowing from Peter to pay Paul in the hope that things would come right eventually, as they did”. Counsel noted that the prosecuting guard had agreed that this was done for the purpose of “keeping the company afloat”.

“One has to give the benefit of the doubt when someone is trying to save a company,” said Mr Hartnett.

Mr Hartnett highlighted the Anglo Irish Bank case which, he said, involved deception that had helped to bring the country to “its financial knees”.

He referenced a number of Anglo related cases for comparison, including that of former Anglo Irish Bank CEO David Drumm who was jailed for his role in a €7.2 billion banking fraud.

The lawyer said in that instance a headline sentence of eight years had been set and this had been reduced to six years after mitigation. He said all the mitigating factors in that case were also present in this case along with others, including Cassidy’s advanced age, ill health and his plea of guilty.

“Is there value in this comparison? I submit there is,” said Mr Hartnett.

Mr Staines said there were differences in the Anglo cases cited by Mr Hartnett and Cassidy’s case. He said in the Anglo case, balance sheets had been inflated artificially, the consequence of which was that an investor would be misled as to the health of the bank.

“The Anglo case wasn’t actual money,” he said. “In this case you’re dealing with real money from real people both big and small.”

Mr Staines said this has resulted in “really significant hardship” for people.

He said the suggestion that because Cassidy was trying to keep the business afloat, he didn’t have a personal motive, was “wrong” - adding that the appellant was CEO of the company at the time and was drawing a salary from it.

In relation to the argument that the maximum headline sentence in the case should have been ten years, Mr Staines submitted that the charge in this case was a common law offence and there was no maximum sentence.

He said the appellant could have been charged with hundreds of counts of theft, forgery and deception but this would not have been practical.

He said if Mr Hartnett was right and the maximum sentence available to the court was 10 years it would be “totally unjust” in a case where there were hundreds of victims.

“In the circumstances it simply cannot be that the court is restricted in such a way,” he said.

“The breath and complexity of the fraud, coupled with the vast numbers of transactions involved and exceptional number of victims meant that a single conspiracy to defraud charge was appropriate to ensure that all the offending behaviour was captured,” he said.

Mr Justice John Edwards, sitting with Ms Justice Tara Burns and Mr Justice Michael MacGrath, said the court would reserve judgement in the matter.