The Government’s vacant property tax of 0.3 per cent has been criticised as “laughable” during Tuesday’s Dáil debate which was dominated by the housing crisis.

It comes after a report by a banking lobby group found that rents in Ireland have increased by more than 80 per cent in 12 years, compared with an average increase of just 18 per cent across the rest of the EU.

The report found that a substantial increase in housing supply would be needed before house prices and rent prices would fall.

During Leaders’ Questions, Social Democrats co-leader Róisín Shortall was among the three opposition TDs who raised the stark findings of the report.

“Two out of three nurses are planning on emigrating, 61% of our primary schools are understaffed, and it’s all down to the cost of housing,” she said.

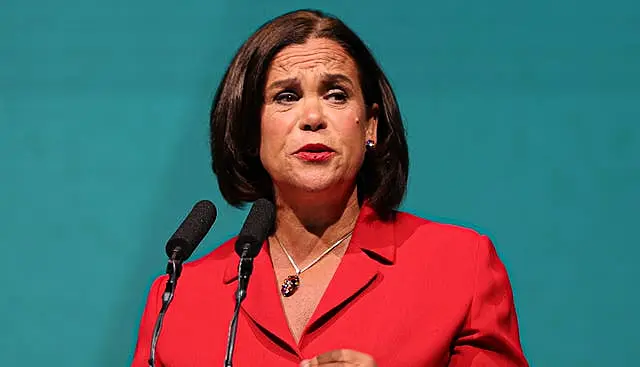

Sinn Fein leader Mary Lou McDonald also raised the issue of young people emigrating due to unaffordable house and rent prices.

“Your policies are driving an entire generation of our young people from here to Perth, to Sydney, to Toronto and beyond,” Ms McDonald said.

“You come in here week after week telling fairy tales, make-believe, imagining that your approach is working when it is plainly failing.”

Ms Shortall told Minister for Public Expenditure Michael McGrath – who took questions from the opposition on Tuesday – that there are tens of thousands of vacant properties across Ireland.

“A proper vacant homes tax can be the fastest, cheapest and more sustainable means of bringing additional homes into use.

“Regrettably, the vacant homes tax that your Government has finally proposed is so low that it’s actually laughable.

“You’ve set the rate at just 0.3 per cent of the value of a property. Minister, do you know that house prices are increasing by 10.8 per cent?

“If the value of your home will increase by more than 10% if you leave it vacant, how on earth is a tax of 0.3 per cent an incentive to bring it back into use?”

“You will soon be Minister for Finance, within the next two weeks, and I’m imploring you to implement a punitive vacant home tax.

“The Social Democrats have proposed a rate of 10 per cent of the value of the home. Will you urgently review the rate of this tax and raised it to a meaningful level?”

Minister McGrath defended the Government’s vacant home tax as “a very significant intervention”.

“It’s the first time that such a tax has been imposed.

“Of course, you can argue about the rate, you can argue about the scope, but we utilised the information that has been gathered by the Revenue Commissioners by way of the returns made in respect of local property tax to construct a new tax and a new intervention with a view to ensuring that as many of those properties as possible come back into use.”

Mr McGrath said that he believes the tax “will play a part” in encouraging vacant property owners to make them available.

“(I) look forward to the debate on your motion, and the government will consider any constructive measure that you have or anyone that’s in this house has to increase the supply of stock.”

Ms Shortall replied: “Minister, I asked you on what basis do you think that a person who can continue to sit on a vacant property and benefit to the tune of 42,000 next year, on what basis do you think that person would be influenced to bring that home into use, to make it available, as a result of a tax of €1,200?

“That just doesn’t make any sense whatsoever.”

Mr McGrath said that both the “carrot” and “stick” were being used to incentivise vacant properties to be used.

“As is always the case with a new tax, we will keep the rate under review, and we will see if it is having the desired effect.”

People-Before-Profit Richard Boyd Barrett criticised the Government for underspending three-quarters of a million euro of their housing budget and raised the fact that the four Dublin local authorities had not built any council houses in the first six months of 2022.

“It is absolutely beyond belief that at the end of this year, you will have underspend the housing budget by €700 million, and you claim that this is a success for the Housing for All plan,” Mr Boyd Barrett said.

“In the first six months of 2022, in the teeth of this crisis, the four Dublin local authorities built no new council houses, and you have failed to spend €700 million that was allocated for housing at all.

“What are you going to do about that?”

“Supply is increasing, and that is a fact,” Mr McGrath said.

“New public stock is not just delivered by our local authorities, it’s also delivered by our approved housing bodies and also by the LDA (Land Development Agency).”