Ireland has the second-highest level of uninsured vehicles in the EU, according to a new report.

A figure of 7.8 percent of private vehicles were on the road here without a valid insurance disc in 2021, only Greece is higher at 8.2 percent.

The level of uninsured vehicles in this country is three times the rate in the UK and four times the average across the EU/EEA area.

That’s the message the Motor Insurers’ Bureau of Ireland (MIBI) will be delivering to the Joint Oireachtas Committee on Transport and Communications when they appear to discuss the issue of uninsured driving on Wednesday.

The MIBI recently published research that showed that one in every 12 private vehicles on Irish roads are uninsured. In 2022 there was a total of just under 188,000 private vehicles driving without insurance in this country.

This represented an increase of 13,626 uninsured vehicles over the 2021 figures.

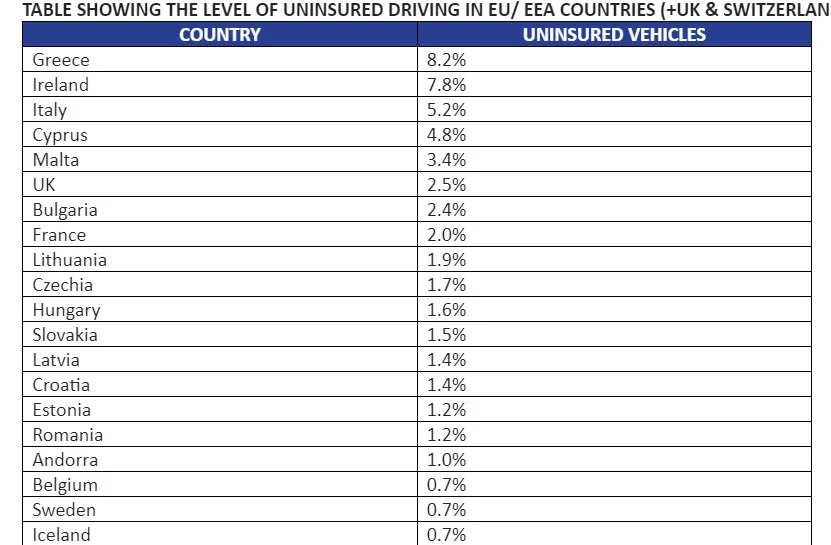

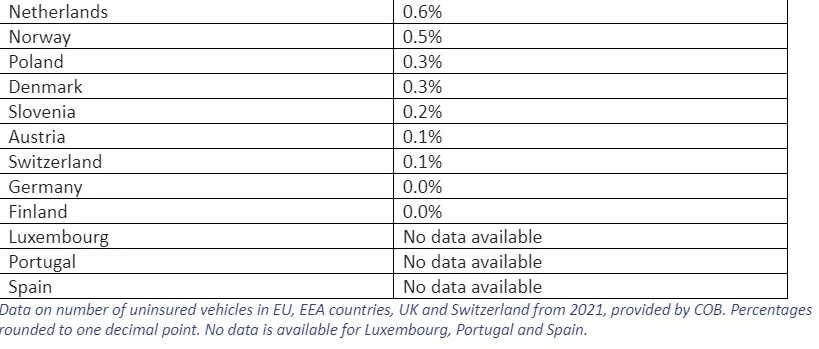

In their presentation to the Oireachtas committee, the MIBI has also undertaken an analysis on the level of uninsured driving across the EU, EEA as well as the UK and Switzerland. The most recent European data comes from 2021, when Ireland recorded a level of 7.8 per cent uninsured vehicles. This was the second-highest level in the EU at the time, behind only 8.2 per cent in Greece.

Updated figures

However, the updated figures for Ireland show that in 2022 the level of uninsured driving reached 8.3 per cent. This would put Ireland at the highest level of uninsured driving in the EU if other countries maintained or reduced the level of uninsured vehicles over the same period.

In the UK the level of uninsured vehicles was 2.5 per cent, France 2 per cent, Croatia 1.4 per cent, Romania 1.2 per cent, Iceland and Sweden 0.7 per cent, Poland 0.3 per cent, while Germany and Finland had effectively no uninsured vehicles.

Of the 29 countries across the EU and EEA (as well as the UK and Switzerland) where data was available, the average level of uninsured vehicles was 1.8 per cent. This means that Ireland had 4.3 times the average level of uninsured vehicles across the EU/ EEA in 2021.

Penalties

Under Irish law, the penalties for vehicles found without valid insurance include An Garda Síochána having the power to seize the vehicle on the spot, as well as other significant penalties such as an automatic court appearance, five penalty points and a substantial fine.

The MIBI is a not for profit organisation that was established to compensate victims of road traffic accidents caused by uninsured and unidentified vehicles.

For Ireland to potentially be the worst country in the EU for uninsured vehicles should make everyone in this country concerned about the rule of law and road safety sit up and take notice.

Speaking ahead of his appearance at the Joint Oireachtas Committee, MIBI CEO David Fitzgerald said, “For Ireland to potentially be the worst country in the EU for uninsured vehicles should make everyone in this country concerned about the rule of law and road safety sit up and take notice. That is a startlingly high figure, and it shows how much of a problem uninsured driving has become in this country.

“We have three times as many uninsured vehicles as our neighbours in the UK and 4 times the EU/ EEA average."

Driving without insurance is not a victimless crime.

Mr Fitzgerald added: “Despite what some people might suggest, driving without insurance is not a victimless crime. It makes our roads less safe and more dangerous. Every year the MIBI pays out in the region of €70m in compensation to victims of accidents caused by uninsured drivers. In 2021, the average cost of each claim paid to the victim of an uninsured driver came to €78,736.

“We are a not for profit organisation, so the funding for that compensation is gathered from all the companies who provide motor insurance in Ireland. Practically, that means that the law-abiding motorists are subsidising uninsured drivers to the tune of approximately €30 - €35 every time they renew their motor insurance policies. That number will increase if the level of uninsured driving continues to grow.

“Action is needed now and that starts with the complete enactment and implementation of the Road Traffic and Roads Bill which enables the full application of the Gardaí’s ANPR (Automatic Number Plate Recognition) system.

"That system will help tackle uninsured driving as Gardaí can see if a car is insured simply by scanning a number plate. If we want to reduce uninsured driving we first need to identify the culprits and this system represents a modern and sophisticated approach to doing just that."