Ireland hopes to tap sovereign wealth funds in the Middle East to invest in infrastructure projects as the Government seeks to keep pace with its fast-growing population.

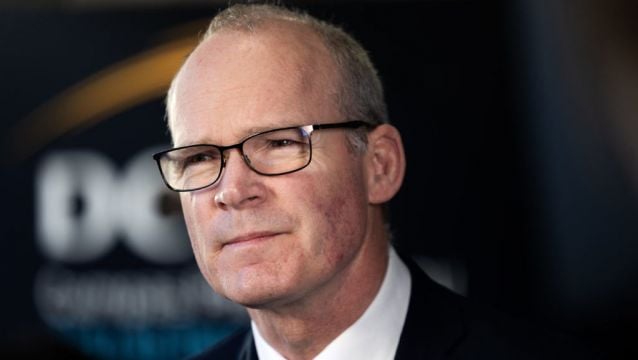

Minister of Enterprise, Trade and Employment Simon Coveney is meeting with potential investors in the Gulf this week during visits to the United Arab Emirates, Saudi Arabia and Kuwait.

"We are always looking for partners to be part of strategic investments in Ireland," he told Reuters in an interview at a World Trade Organisation meeting of trade ministers in Abu Dhabi.

The Minister's comments highlight the gravitational pull of the Gulf states whose government-controlled funds have become go-to-investors in everything from infrastructure to technology.

"There are exciting investment opportunities in Ireland that I think can provide a consistent return in the medium term," Mr Coveney said, describing the economy as unprecedentedly resilient.

"Ireland has very strong economic growth at the moment. We're running trade surpluses, consistently year after year, which is historically unusual for Ireland," he said on Monday.

Mr Coveney said Ireland also had funding options available at home. The Government last year laid out plans for a €100 billion sovereign wealth fund and a smaller €14 billion infrastructure and climate fund.

Gulf state the UAE, a small nation but major re-exporting hub, has traditionally been one of Ireland's top trading partners in the Middle East. Mr Coveney said trade with UAE and Saudi Arabia has increased significantly, which could bring Gulf fund investments to Ireland over the coming years.

Ireland is seeking funding for offshore wind, electricity grids, public transport, road infrastructure and housing after decades of under-investment compounded by the 2008 global financial crisis and a since growing population.

"Ireland has the youngest population and the fastest growing population in Europe right now so there are capacity challenges for us to keep pace with that growth," Mr Coveney said.