Intel is cutting close to 17,000 jobs and suspending its dividend payments.

The chipmaker, which employs close to 4,900 people in Ireland, said on Thursday it would cut more than 15 per cent of its workforce and suspend its dividend starting in the fourth quarter as the chipmaker pursues a turnaround centred around its loss-making manufacturing business.

While it's unclear how the job cuts will be spread across the company, if the losses are shared across the business it could mean the company's facility in Leixlip, Co Kildare will be impacted.

Aidan Donnelly, Head of Global Equities at Davy Stockbrokers, told Newstalk the company has had a drop in revenue.

"They’re building several new plants in the US, aided by money from the US government... So there is a lot going on, unfortunately, we’re in an earning season where you don’t disappoint because the stock market is taking no prisoners," he said.

A majority of the job cuts will be completed by the end of 2024, Intel said. The company's headcount was 124,800 at the end of 2023.

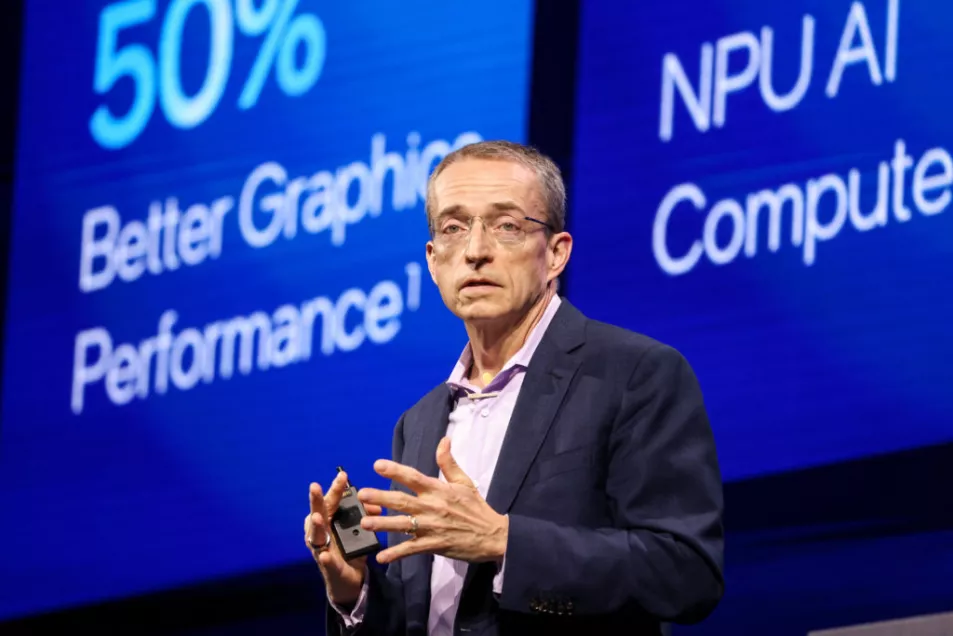

"I need less people at headquarters, more people in the field, supporting customers," CEO Pat Gelsinger said in an interview.

The company also set out plans to cut operating expenses and reduce capital expenditure of more than $10 billion (€9.25 billion) in 2025.

Intel previously reduced its workforce by roughly 5 per cent in 2023, with the loss of close to 130 jobs in its Irish operation, based mainly at its production facility in Leixlip, Co Kildare.

Shares of the company slumped 20 per cent in extended trade, setting it up to lose more than $24 billion (€22.2 billion) in stock market value.

The stock had closed down 7 per cent on Thursday, in tandem with US chip stocks plummeting after a conservative forecast from Arm Holdings on Wednesday.

Much of Wall Street's focus has centred around the heavy investments and huge costs incurred by Intel as it builds-out its manufacturing capacity in a bid to compete against Taiwan's TSMC.

Intel's lagging position in the market for AI chips has also sent its shares down more than 40 per cent so far this year, as investors temper their expectations for the company's growth in the booming market.

"A $10 billion cost reduction plan shows that management is willing to take strong and drastic measures to right the ship and fix problems. But we are all asking, 'is it enough' and is it a bit of a late reaction considering that CEO Gelsinger has been at the helm for over three years?" said Michael Schulman, chief investment officer of Running Point Capital.

As part of its cost reduction plan, Intel expects capital expenditures in 2024 to between $25 billion and $27 billion and is targeting gross capital expenditures between $20 billion and $23 billion for 2025.

Intel had recorded capital expenditures of $25.8 billion in 2023, compared to $24.8 billion in 2022. It was $18.7 billion in 2021 when Gelsinger took charge.

In February last year, the company had set out to provide annual cost savings between $8 billion and $10 billion by 2025.

"Our objective is to come back with the dividend, to pay a competitive dividend over time, but right now, focusing on the balance sheet, deleveraging," said Gelsinger.

"Deleveraging and capital investments are, we believe, a greater shareholder return right now than paying a dividend."

In April, Intel declared a quarterly dividend of 12.5 cents per share.

Intel also forecast third-quarter revenue below estimates as it grapples with a pullback in spending on traditional data centre chips and increased competition in the personal computer market.

The company expects revenue to be between $12.5 billion and $13.5 billion for the quarter, compared with analysts' average estimate of $14.35 billion, according to LSEG data. - Reuters