The Bank of England heaped further pressure on mortgage holders on Thursday as it hiked interest rates again in yet another bid to get inflation under control.

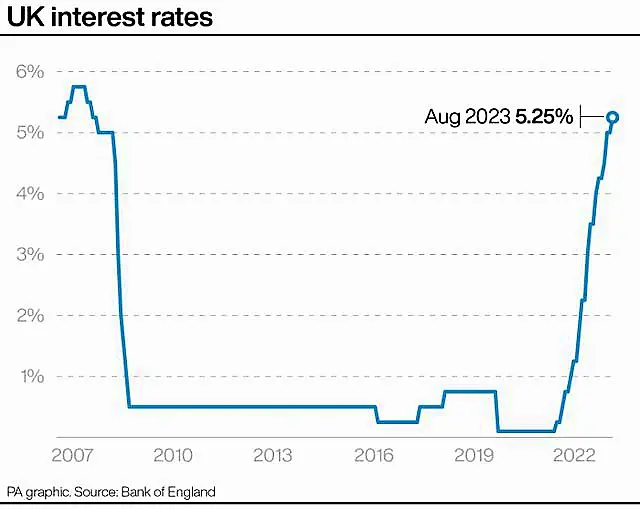

The Bank warned of “crystallising” risks which were pushing inflation upwards as it decided to increase its base rate to 5.25 per cent from 5 per cent. It is the 14th rate increase in a row.

But in a good sign for the British prime minister, the Bank said it expects the Government to meet its promise to halve inflation by the end of the year.

The Consumer Prices Index will probably fall below 5% in the final quarter of 2023, it said.

Bank Governor Andrew Bailey said: “Inflation is falling and that’s good news.

“We know that inflation hits the least well off the hardest and we need to make absolutely sure that it falls all the way back to the 2% target.

“That’s why we’ve raised rates to 5.25% today.”

However, in an unusual three-way disagreement, two members of the Bank’s decision-making Monetary Policy Committee (MPC) voted to hike the rate further, while one wanted to keep it unchanged.

The majority said that some of the risks of more persistent domestic inflation had “crystallised,” a word which the bank used repeatedly through its report on Thursday.

It said that increases in private-sector workers’ wages and other factors which could make inflation more persistent had “begun to crystallise.”

The economy had shown “surprising resilience” over several quarters, and the Bank forecast on Thursday that the UK looked set to avoid a recession.

It said that its interest rates were “weighing on economic activity.”

It said it would if necessary keep the rate higher for longer to try to get inflation down.

Two MPC members, Jonathan Haskel and Catherine Mann, disagreed with the majority and thought that rates should be hiked to 5 per cent.

They said that the Bank had repeatedly underestimated how high inflation would remain and that it was “important to lean more actively against inflation persistence.”

“For these members, a forceful increase in Bank rate at this meeting would help to bring inflation back to the 2% target sustainably in the medium term, and to reduce the risks of a more costly tightening later,” the report from the meeting said.

MPC member Swati Dhingra thought it would be better not to change the rate at all.

She argued that the risks of increasing it too far had continued to build and could create a situation where the Bank would be forced to rapidly slash rates in future.

It takes a long time for rate rises to come through, she added.

Indeed a lot of the drop in inflation that the Bank forecast on Thursday came not from the interest rate hikes it has been making since December 2021, when rates were at just 0.1 per cent, but from the drop in energy bills.

The average household is expected to pay less than £2,000 for their energy when the price cap is next changed in October, the Bank’s forecast said.

Outside the Bank on a sunny Thursday morning, a small protest of around half a dozen people gathered to protest against interest rate hikes.