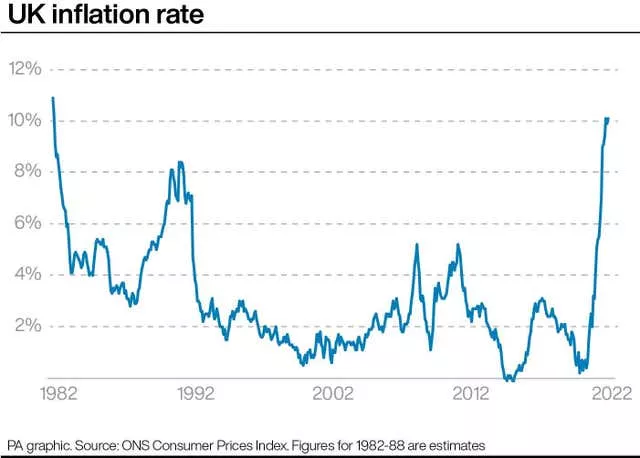

Inflation in the UK last month returned to the 40-year high it hit earlier this summer after food prices soared.

The UK's Office for National Statistics (ONS) said Consumer Prices Index inflation reached 10.1 per cent in September, compared with 9.9 per cent in August.

It was above the expectations of economists, who had predicted a figure of 10 per cent.

The figure matches the 40-year high inflation hit in July and remains well above the British government’s target of 2 per cent.

The increase was driven by food prices, leaping by 14.5 per cent compared with the same month last year, representing the largest annual rise since 1980, according to data modelling.

Meanwhile, housing and utilities costs leapt by 20.2 per cent against the same month last year.

ONS director of economic statistics Darren Morgan said: “After last month’s small fall, headline inflation returned to its high seen earlier in the summer.

“The rise was driven by further increases across food, which saw its largest annual rise in over 40 years, while hotel prices also increased after falling this time last year.

“These rises were partially offset by continuing falls in the costs of petrol, with airline prices falling by more than usual for this time of year and second-hand car prices also rising less steeply than the large increases seen last year.

“While still at a historically high rate, the costs facing businesses are beginning to rise more slowly, with crude oil prices actually falling in September.”

Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose 8.8% in the year to Sept 2022, up from 8.6% in Aug.

This return to July’s recent high was mainly driven by rising food prices.

➡️ https://t.co/FAr33KMgCL pic.twitter.com/3wIP43yb4M— Office for National Statistics (ONS) (@ONS) October 19, 2022

Advertisement

Economists at the ONS said rising transport prices slowed significantly last month on the back of cheaper fuel costs.

The Bank of England warned last month that inflation is expected to peak in October at just below 11 per cent, following UK government support to freeze energy bills at £2,500 for an average household.

New British chancellor Jeremy Hunt said on Wednesday he would prioritise help for the vulnerable after the inflation increase was revealed.

Mr Hunt said: “I understand that families across the country are struggling with rising prices and higher energy bills.

“This government will prioritise help for the most vulnerable while delivering wider economic stability and driving long-term growth that will help everyone.

“We have acted decisively to protect households and businesses from significant rises in their energy bills this winter, with the government’s energy price guarantee holding down peak inflation.”

The September reading is important for the British treasury as the figure is usually used as the benchmark to raise benefits and the state pension, although the government has refused to commit to this in recent days.

Commenting on today’s inflation figures, ONS Director of Economic Statistics, Darren Morgan, said: (1/3)

⬇️ pic.twitter.com/lQfWG3XYzw— Office for National Statistics (ONS) (@ONS) October 19, 2022

If the government decides to uprate benefits by inflation, 10.1 per cent is the percentage they will be increased by and this will come into effect from next April.

September’s inflation figure is also used by the department within the triple-lock commitment which sees state pensions rise by the highest of three figures: average earnings, CPI inflation based on September’s rate or 2.5 per cent.

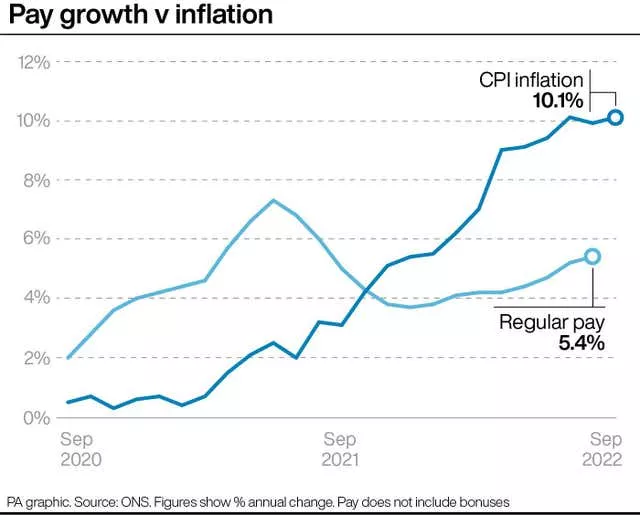

With average earnings most recently hitting 5.4 per cent, pensions would therefore rise by 10.1 per cent if the government sticks to this manifesto commitment.

The inflation rate will also be used to decide the increase in business rates: the property tax facing high street firms.

Martin Beck, chief economic adviser to the EY Item Club, said he now “expects the CPI measure to peak at around 11 per cent in October, followed by a more gradual decline than previously anticipated, caused by the recent fall in sterling”.

He added: “However, the outlook for inflation beyond the next few months has become more uncertain following the recent fiscal U-turns made by the new chancellor.

“On the one hand, a tighter fiscal policy will weigh on demand, so should bear down on inflation in the medium term – as well as putting less pressure on the MPC (Monetary Policy Committee) to raise interest rates aggressively.

“But on the other, the decision to end the energy price guarantee next April, rather than October 2024, could lead to inflation rising next spring.”

Retail Price Index inflation (RPI) increased to 12.6 per cent, while CPI including housing costs (CPIH) returned to 8.8 per cent in September from 8.6 per cent in August, the ONS said.